Why Choose Us

- Ranked in the top 20 law firms by Trustpilot

- Nationwide Legal Coverage

- Free Consultation

- Fixed Fee Terms

- Competitive Rates

- Flexible Payment Plans

- Trusted Legal Care

- UK’s Leading Motoring Solicitors

4.8 out of 5

Our customers rate us

“EXCELLENT”

AS SEEN ON

13.04.2015

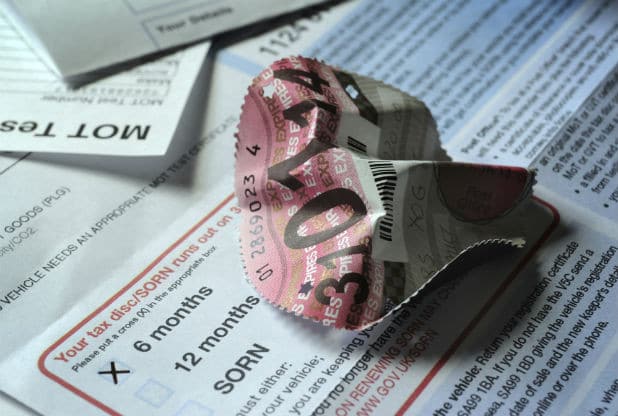

Buying a used car? What you need to know about road tax

Car dealers are being advised to notify buyers that the car tax of a second-hand vehicle is automatically cancelled when it changes ownership.

Car dealers are being advised to notify buyers that the car tax of a second-hand vehicle is automatically cancelled when it changes ownership.

The advice follows the news that thousands of car owners are being fined and having their cars towed away after major changes were made to the tax disc system last October.

Paper tax discs no longer need to be displayed on windscreens and are now processed digitally instead. So if you buy a used car, the emphasis is on you to make sure you pay the road tax, either by visiting a post office or by going online.

Before the changes, agencies working on behalf of DVLA clamped around 5,000 vehicles a month. This has now risen to almost 8,000 – with some towed away without even a warning letter.

So here a few things you need to be aware of if you’re buying a used car in order to make sure you don’t become the latest motorist to be fined or worse.

When did it change and why?

After requiring drivers to display a paper tax “disc” for nearly 93 years, the government abolished the road tax certificate on 1 October last year. Road tax can now be paid for more quickly via the Post Office or by visiting the DVLA website and the cost can be spread monthly with direct debit payments rather than having to shell out lump sums every six to 12 months.

I’m about to buy a second-hand car. What should I do?

If you’re buying a second-hand car then the advice is to pay the road tax by visiting the Post Office, phoning the DVLA or via their website. This is because drivers will no longer be able to use the tax disc of the previous owner.

I’m selling my car. What should I do?

The tax for a particular car is cancelled immediately after a change in ownership, If you have paid your tax in advance and believe you are owed money then the DVLA should send you an automatic refund. You are also advised to check that you have given the department your correct address to allow this to happen.

Why Choose Us

We have been successfully representing clients in motoring courts nationwide

Contact us for a free consultation, our expert solicitors will be able to discuss your case and advise on legal options.

Birmingham

Bradford

Bristol

Carlisle

Cardiff

Chelmsford

Huddersfield

Hull

Manchester

Liverpool

Leeds

London

Newcastle

Norwich

Nottingham

Sheffield